I giochi di Rockstar Studios trainano le vendite.

I giochi di Rockstar Studios trainano le vendite.

Take-Two, la società che distribuisce i prodotti realizzati dalle varie software house come Rockstar Games e 2K Games, ha rilasciato il report finanziaro con il risultato del quarto trimestre 2011 e con gli obiettivi per il futuro.

Tra questi spiccano le date di uscita di alcuni titoli. Gran Theft Auto V avrà il suo momento topico per l’annuncio ufficiale al E3 2012. XCOM, lo sparatutto di 2K Marin, slitta addirittura all’anno fiscale 2014, denotando forti problemi di realizzazione che forse solo la prossima generazione di console può risolvere.

Grande successo per le vendite in digital delivery degli episodi inerenti in franchise GTA, così come buone le entrate dai titoli sportivi di 2K Sports.

Maggiori dettagli nel comunicato ufficiale:

Take-Two Interactive Software, Inc. Reports Results for Fourth Quarter and Fiscal Year 2012![]()

Net Revenue for Fiscal Year 2012 was $825.8 Million

Non-GAAP Net Loss Per Diluted Share for Fiscal Year 2012 was $0.71

Company Expects Non-GAAP Net Income Per Diluted Share of $2.00 to $2.25 for Fiscal Year 2013

NEW YORK–(BUSINESS WIRE)–May. 22, 2012– Take-Two Interactive Software, Inc. (NASDAQ:TTWO) today reported financial results for the fourth quarter and fiscal year ended March 31, 2012, which were in line with its most recent financial outlook. In addition, the Company provided its financial outlook for the first quarter and fiscal year 2013.

Fiscal Year 2012

For the fiscal year ended March 31, 2012, net revenue was $825.8 million, as compared to $1,136.9 million for the fiscal year ended March 31, 2011, which had benefited from the release of Red Dead Redemption. GAAP loss from continuing operations was $107.7 million, or $1.30 per diluted share, as compared to GAAP income from continuing operations of $53.8 million, or $0.62 per diluted share, for the prior fiscal year. Non-GAAP net loss was $59.4 million, or $0.71 per diluted share, as compared to Non-GAAP net income of $94.3 million, or $1.02 per diluted share, for the prior fiscal year.

The strongest contributors to net revenue in fiscal year 2012 were L.A. Noire, NBA 2K12, the Grand Theft Auto franchise, Duke Nukem Forever and Red Dead Redemption. Digitally delivered content accounted for 13% of net revenue, as compared to 9% in fiscal year 2011, driven by offerings for the Grand Theft Auto franchise, Red Dead Redemption, the Sid Meier’s Civilization franchise, Borderlands and L.A. Noire.

Fiscal Fourth Quarter 2012

For the fourth quarter ended March 31, 2012, net revenue was $148.1 million, as compared to $182.3 million for the fourth quarter ended March 31, 2011, which had benefited from the post-launch performance of Red Dead Redemption. GAAP loss from continuing operations was $66.0 million, or $0.78 per diluted share, as compared to $22.4 million, or $0.27 per diluted share, for the year-ago period. Non-GAAP net loss was $50.9 million, or $0.60 per diluted share, as compared to $14.4 million, or $0.18 per diluted share, for the year-ago period.

The strongest contributors to net revenue in the fourth quarter were new titles including NBA 2K12, Major League Baseball 2K12 and The Darkness II; and catalog sales led by the Grand Theft Auto franchise and Red Dead Redemption. Digitally delivered content accounted for 19% of net revenue, as compared to 15% in fiscal fourth quarter 2011, driven by offerings for the Grand Theft Auto franchise, the Sid Meier’s Civilization franchise, Red Dead Redemption, Borderlands, NBA 2K12 and L.A. Noire.

Management Comments

“Fiscal 2012 was a year of creative, operational and strategic achievement by our Company,” said Strauss Zelnick, Chairman and CEO of Take-Two. “We delivered groundbreaking titles, including L.A. Noire and NBA 2K12, which set new standards for excellence; grew our revenue from digitally delivered content and mobile offerings; made substantial progress on our online gaming initiatives; and bolstered our already strong liquidity through a convertible notes offering. While our financial results were disappointing, the decisions we made position Take-Two for growth and profitability both this year and over the long-term.

“Fiscal 2013 kicked off with the successful launch of Max Payne 3, which received outstanding reviews and promises to be another hit for Rockstar Games. We have a fantastic lineup of upcoming releases for the balance of the year and the strongest development pipeline in the Company’s history.”

Business and Product Highlights

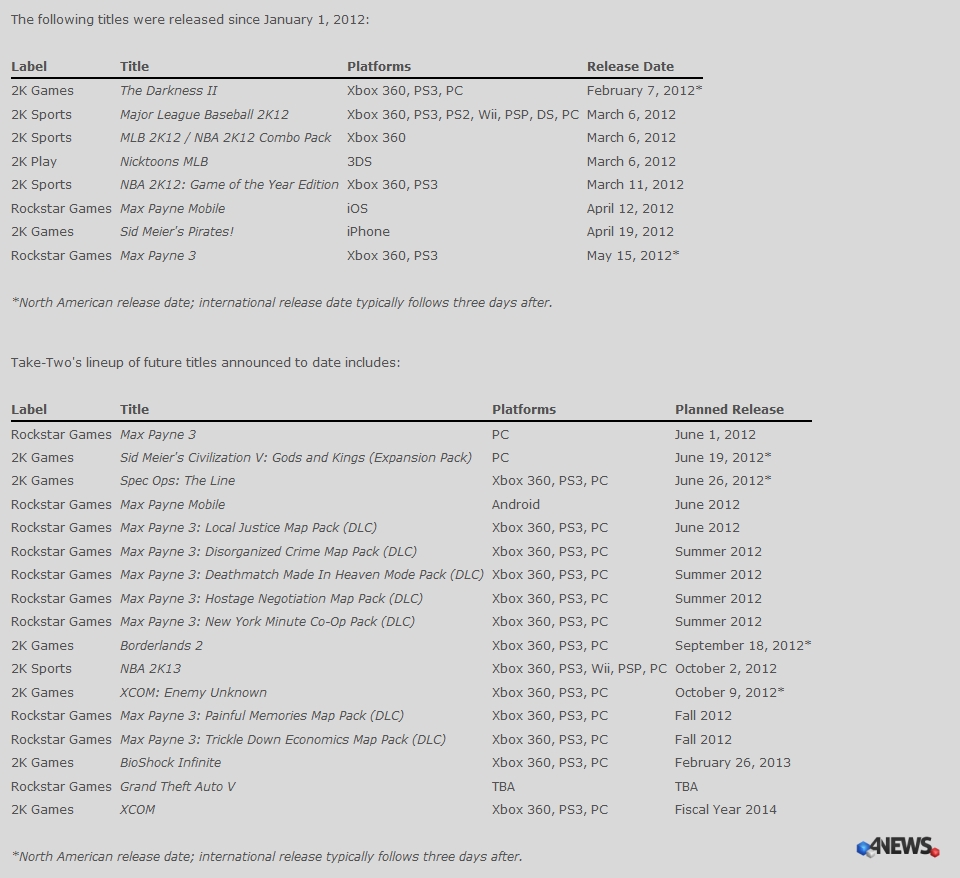

Since January 1, 2012:

Rockstar Games:

-

Launched Max Payne 3 on May 15 in North America and May 18 internationally on Xbox 360 and PS3. The title received excellent reviews and sold-in approximately 3 million units during its initial launch. Max Payne 3 will also be available for the PC on June 1.

-

Announced a comprehensive downloadable content plan for Max Payne 3, with new releases starting in June and extending through the fall. Consumers can preorder all of this upcoming content at a discount by purchasing the Max Payne 3 Rockstar Pass.

-

Released a major update to its Rockstar Games Social Club community service delivering enhanced social and connected gameplay features to its nearly 15 million members.

-

Released Max Payne Mobile on April 12, enabling fans to experience the classic 2001 release, Max Payne, optimized for the iPad, iPhone and iPod touch.

-

Released a touch-enabled version of L.A. Noire for the OnLive platform.

2K:

-

2K Sports released Major League Baseball 2K12 on March 6, featuring Cy Young Award winning pitcher Justin Verlander of the Detroit Tigers as the cover athlete and, for the third year in a row, executed the MLB 2K Perfect Game Challenge, which is airing on Spike TV on May 24.

-

2K Play released Nicktoons MLB 3D on March 6, the first baseball game designed exclusively for the Nintendo 3DS.

-

2K Games launched The Darkness II on February 7 in North America and February 10 internationally. The title received favorable reviews, including an average Metacritic score of 80 on Xbox 360.

-

2K Sports released the NBA 2K12: Game of the Year Edition on March 11, which includes the full retail version of NBA 2K12 along with the previously released Legend’s Showcase add-on content and a commemorative poster. NBA 2K12 is the highest rated title in the history of 2K Sports with an average Metacritic score of 90 on Xbox 360 and PS3. Despite the NBA lockout, the title sold-in over 5 million units for the second year in a row.

-

2K Games announced that XCOM: Enemy Unknown, which is in development at Firaxis Games and will feature both deep strategy and intense action, is planned for release on October 9, 2012 in North America and October 12, 2012 internationally.

-

2K Games announced that BioShock Infinite is now planned for launch on February 26, 2013. Developed by Irrational Games – the original creator of the BioShock franchise which has sold-in over 9.5 million units to date – BioShock Infinite won more than 75 editorial awards at E3 in 2011, including the Game Critics Awards’ Best of Show.

-

2K Games announced that Borderlands 2, the sequel to the hit shooter-looter that has sold in nearly 6 million units to date, is expected to launch on September 18, 2012 in North America and September 21, 2012 internationally.

-

2K Games announced that Spec Ops: The Line, a heart-pounding military shooter that explores the dark realities of war, will launch on June 26, 2012 in North America and June 29, 2012 internationally. A playable demo is available now on the Xbox LIVE online entertainment network and the PlayStation Network.

-

2K Games announced that Sid Meier’s Civilization V: Gods & Kings, the expansion pack for the award-winning PC strategy title, Civilization V, will be released on June 19, 2012 in North America and June 22, 2012 internationally.

-

2K Games now expects to release XCOM, its shooter version of the franchise that is in development at 2K Marin, during fiscal year 2014.

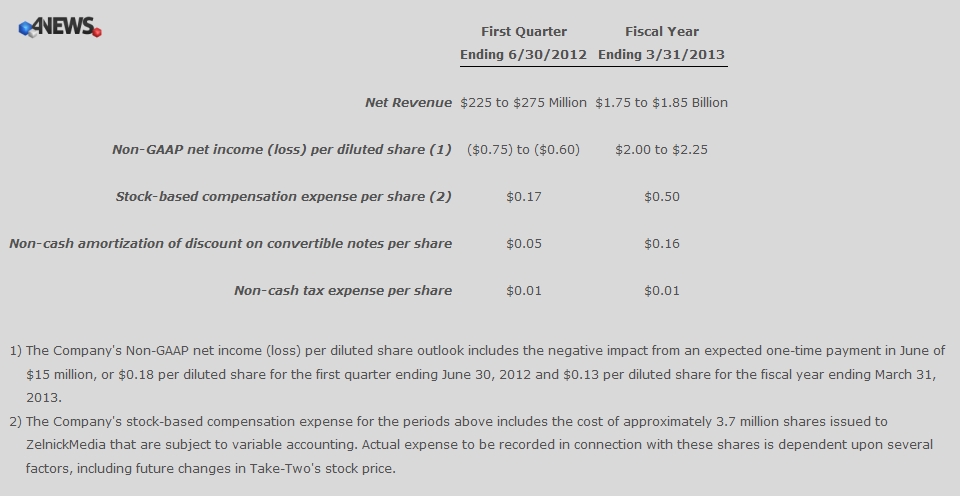

Financial Outlook for Fiscal 2013

Take-Two is providing its financial outlook for the first quarter ending June 30, 2012 and fiscal year ending March 31, 2013 as follows:

Key assumptions and dependencies underlying the Company’s financial outlook include continued consumer acceptance of current generation video game and computer entertainment systems; the ability to develop and publish products that capture market share for these systems; the timely delivery of the titles included in this financial outlook; and stable foreign exchange rates. See also “Cautionary Note Regarding Forward Looking Statements” below.

Product Releases

Conference Call

Take-Two will host a conference call today at 4:30 p.m. Eastern Time to review these results and discuss other topics. The call can be accessed by dialing (877) 407-0984 or (201) 689-8577. A live listen-only webcast of the call will be available by visiting http://ir.take2games.com and a replay will be available following the call at the same location.

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses Non-GAAP measures of financial performance that exclude certain non-recurring or non-cash items. Non-GAAP gross profit, income (loss) from operations, net income (loss), and earnings (loss) per share are measures that exclude certain non-recurring or non-cash items and should be considered in addition to results prepared in accordance with GAAP. They are not intended to be considered in isolation from, as a substitute for, or superior to, GAAP results. These Non-GAAP financial measures may be different from similarly titled measures used by other companies.

The Company believes that these Non-GAAP financial measures, when taken into consideration with the corresponding GAAP financial measures, are important in gaining an understanding of the Company’s ongoing business. These Non-GAAP financial measures also provide for comparative results from period to period. Therefore, the Company believes it is appropriate to exclude certain items as follows:

-

Stock-based compensation – the Company does not consider stock-based compensation charges when evaluating business performance and management does not contemplate stock-based compensation expense in its short- and long-term operating plans. As a result, the Company has excluded such expenses from its Non-GAAP financial measures.

-

Business reorganization, restructuring and related expenses – the Company does not engage in reorganization activities on a regular basis and therefore believes it is appropriate to exclude business reorganization, restructuring and related expenses from its Non-GAAP financial measures.

-

Income (loss) from discontinued operations – the Company does not engage in sales of subsidiaries on a regular basis and therefore believes it is appropriate to exclude such gains (losses) from its Non-GAAP financial measures. As the Company is no longer active in its discontinued operations, it believes it is appropriate to exclude income (losses) thereon from its Non-GAAP financial measures.

-

Professional fees and expenses associated with unusual legal and other matters – the Company has incurred expenses for professional fees and has accrued for legal settlements that are outside its ordinary course of business. As a result, the Company has excluded such expenses from its Non-GAAP financial measures.

-

Non-cash amortization of discount on convertible notes – The Company records non-cash amortization of discount on convertible notes as interest expense in addition to the interest expense already recorded for coupon payments. The Company excludes the non-cash portion of the interest expense from its Non-GAAP financial measures because these amounts are unrelated to its ongoing business operations.

-

Non-cash tax expense for the impact of deferred tax liabilities associated with tax deductible amortization of goodwill – due to the nature of the adjustment as well as the expectation that it will not have any cash impact in the foreseeable future, the Company believes it is appropriate to exclude this expense from its Non-GAAP financial measures.

About Take-Two Interactive Software

Headquartered in New York City, Take-Two Interactive Software, Inc. is a leading developer, marketer and publisher of interactive entertainment for consumers around the globe. The Company develops and publishes products through its two wholly-owned labels Rockstar Games and 2K, which publishes its titles under the 2K Games, 2K Sports and 2K Play brands. Our products are designed for console systems, handheld gaming systems and personal computers, including smartphones and tablets, and are delivered through physical retail, digital download, online platforms and cloud streaming services. The Company’s common stock is publicly traded on NASDAQ under the symbol TTWO. For more corporate and product information please visit our website at http://www.take2games.com.